speak for ACKO

speak for ACKO

speak for ACKO

Home / Life Insurance / Articles / Life Insurance General / Moratorium Period in Life Insurance

Moratorium Period in Life Insurance

Neviya LaishramDec 29, 2025

Share Post

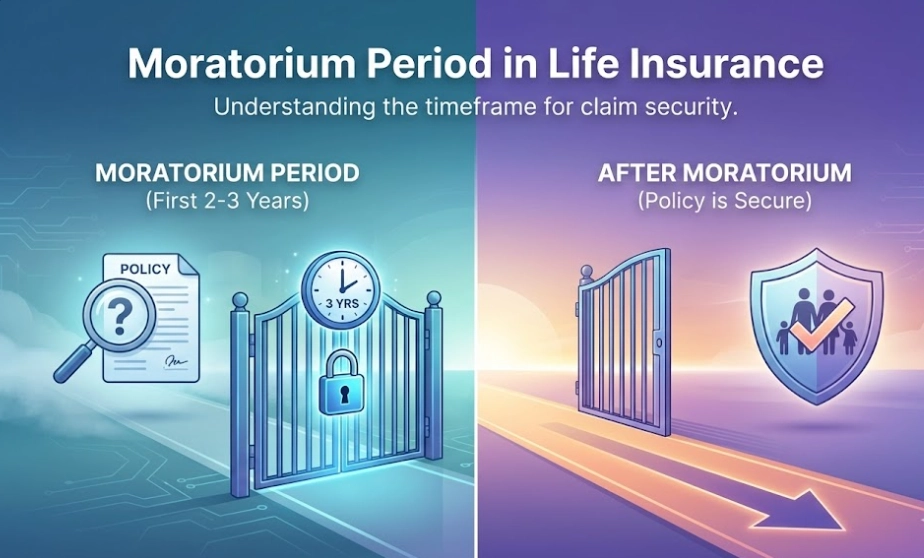

The moratorium period in life insurance is a fixed time during which the insurer can review or investigate the information shared by the policyholder at the time of buying the policy. After this period ends, the policy cannot be questioned or claims rejected for past non-disclosures, except in cases of proven fraud.

Contents

What is the Moratorium Period in Life Insurance?

In simple terms, the moratorium period is the time during which the insurer can check and question the information you gave when buying the life insurance policy. During this period:

The insurer may verify details shared in the proposal form.

Claims can be investigated more closely if any information appears incorrect or incomplete.

This period does not affect your coverage. Your life insurance cover starts as intended once the policy is issued. The moratorium period only determines how long the insurer can question past disclosures.

Is the 3-Year Rule in Life Insurance also called a Moratorium Period?

Yes. In India, the 3-year rule under Section 45 of the Insurance Act is commonly referred to as the moratorium period or the incontestability period in life insurance. Once this period ends, the policy becomes incontestable, and claims cannot be rejected for non-disclosure except in cases of proven fraud.

How Long is the Moratorium Period in India?

In India, the moratorium period for life insurance is 3 years. These 3 years are counted from the latest of the following:

Date of policy issuance

Date of commencement of risk

Date of policy revival (if it lapsed earlier)

Date a rider is added to the policy

What is Section 45 of the Insurance Act?

Section 45 of the Insurance Act, 1938, is a rule that protects life insurance claims. It sets a time limit on when life insurance claims can be questioned. After this period, claims cannot be rejected for past non-disclosures unless fraud is proven.

This rule exists to balance fairness on both sides. It gives insurers a reasonable time to verify details early and provides families with assurance that valid claims will be settled.

In this context, fraud means deliberately hiding or lying about important information.

Why is the Moratorium Period Important for Policyholders?

The moratorium period helps by giving insurers time to verify details early on, at the same time ensuring that families are not left dealing with claim issues years later.

It encourages both insurers and buyers to be more careful and honest when the policy is bought.

It protects genuine claims from rejection due to old or non-material non-disclosures

It discourages the misuse of life insurance during the initial policy years.

It provides long-term trust and certainty for policyholders and their families.

Wrapping Up

Life insurance is meant to be a long-term promise to your family. The moratorium period supports this promise by allowing early checks, while ensuring that after a few years, the policy cannot be questioned for past non-disclosures, except in cases of fraud.

Frequently Asked Questions

Below are some of the frequently asked questions on Moratorium Period in Life Insurance

Is the moratorium period applicable to term insurance?

Yes. The 3-year moratorium period applies to all life insurance policies, including term insurance.

Can a life insurance claim be rejected after 3 years?

A life insurance claim cannot be rejected after 3 years for non-disclosure, unless the insurer can prove fraud.

What is the death claim within 3 years of a policy called?

A death claim made within the first 3 years of a life insurance policy is commonly referred to as an early claim. Such claims may be reviewed more closely by the insurer to verify the information shared at the time of buying the policy.

What is the 3-year rule in term insurance?

The 3-year rule in term insurance means that after a policy completes three years, claims cannot be rejected for past non-disclosures, except in cases of proven fraud. This rule is defined under Section 45 of the Insurance Act.

Recent

Articles

Moratorium Period in Life Insurance

Neviya Laishram Dec 29, 2025

Who is an Appointee in Life Insurance?

Neviya Laishram Dec 22, 2025

What is Survival Benefit in Life Insurance?

Neviya Laishram Dec 22, 2025

How to Renew Your Individual Health Insurance Policy Easily Online

Roocha Kanade Dec 19, 2025

Is ₹1 crore term insurance enough?

Neviya Laishram Dec 17, 2025

All Articles

Want to post any comments?

ACKO Term Life insurance reimagined

ARN:L0072|*T&Cs Apply

Check life insurance