Home / Health Insurance / Articles / Individual Health Insurance / How to File an Individual Health Insurance Claim (Cashless and Reimbursement)

How to File an Individual Health Insurance Claim (Cashless and Reimbursement)

Roocha KanadeDec 11, 2025

Share Post

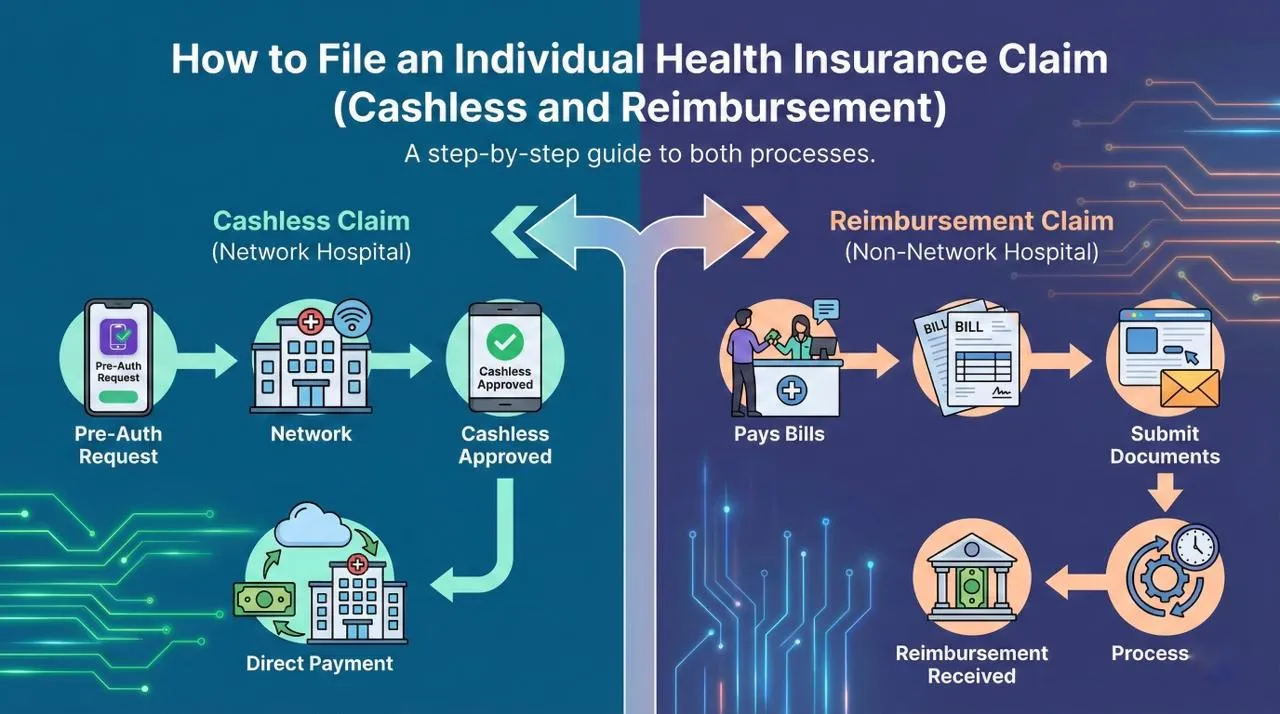

Filing a health insurance claim means making a request to your insurance company to cover medical expenses according to the benefits described in your policy. In case of hospitalisation or treatment, the insurance company pays the bill directly to the hospital or reimburses you later.

The two common ways of raising a claim against your individual health insurance plan are , availing a cashless claim in a network hospital or making a reimbursement claim in case of a non-network hospital. Here’s a step-by-step explanation of both claim processes, documents required, and common tips to ensure smooth approval.

Contents

- Types of Individual Health Insurance Claims

- Step-by-Step Process for Individual Cashless Health Insurance Claims

- Step-by-Step Process for Individual Reimbursement Health Insurance Claims

- Documents Required for Individual Health Insurance Claims

- Common Reasons for Individual Health Insurance Claim Rejection

- Tips for a Hassle-Free Individual Health Plan Claim Process

- Conclusion

- Frequently Asked Questions

Types of Individual Health Insurance Claims

When you need to use your health insurance, you can file your claim in two ways. Understanding the difference helps you choose the smoother and faster option.

Cashless claim: Cashless claim lets you get treated in a network hospital without you having to pay the big hospital bill yourself. The coordination is done by the hospital itself with the insurer, and the approved expenses are settled on your behalf. You pay only for those items that are not covered.

Reimbursement claim: In the case of a reimbursement claim, you pay the hospital bill yourself first and then submit all documents to your insurance provider later. The approved amount is then transferred to your bank account. A tip here that would prove to be useful is making sure to check if a hospital comes in your insurer's network or not. It makes your experience quicker and helps you avoid large out-of-pocket payments.

Step-by-Step Process for Individual Cashless Health Insurance Claims

A cashless claim is usually the most convenient route, especially during an emergency. Here is how it works from start to finish.

Choose a Network Hospital

First, look for a hospital that is included in your insurance company's network. You will find this list on their website or app. Once you reach the hospital, you have to inform the TPA desk or insurance help desk about your health insurance policy. The TPA will assist you with all the paperwork required to get approvals.

Fill the Pre-Authorisation Form

The hospital team assists in filling up a pre-authorisation form, which contains medical details, the reason for admission, and policy information. This is submitted to the insurer to obtain approval. Most insurers have now given near real-time authorisation, even for planned treatments.

Verification and Approval

The insurance company checks the pre-authorisation request, verifies your policy coverage, and confirms whether the treatment is eligible. For planned hospitalisations, this approval comes within a few hours. In emergencies, insurers usually try to speed up the decision.

Hospitalisation and Treatment

You can then undergo the treatment once your cashless claim gets approved. All the eligible expenses are settled directly between the hospital and the insurer. You only need to settle non-payable items like registration charges or certain personal consumables.

Post-Discharge Documentation

After discharge, the hospital gives you your discharge summary, medical reports and final bill. Keep these safely. Some insurers may ask for soft copies later for record updates or claim audits.

Step-by-Step Process for Individual Reimbursement Health Insurance Claims

If you go to a non-network hospital or prefer to pay initially and claim later, use the reimbursement method. Here is the complete process.

Get Treatment at Any Hospital

You are free to visit any registered hospital, even if it is not part of your insurer’s network. Reimbursement claims work well when your preferred doctor or hospital is not on the insurer’s cashless list.

Pay Hospital Bills and Collect All Documents

At the time of discharge, you must pay the bill and get all the necessary paperwork done. For example, discharge summary, treatment records, diagnostic reports, prescriptions, and pharmacy bills. These documents are important for filing a claim.

Submit Reimbursement Form to Insurer

Next, fill the reimbursement claim form and submit it along with your documents. You can usually upload them online through the insurer’s website or app. Check your policy for submission timelines, as many insurers ask you to file a claim within a set number of days after discharge.

Verification and Settlement

The insurance company will check the coverage and exclusions of your policy and approve the claim if valid.

Timelines and Follow-Ups

Reimbursement claims typically take around 5 to 15 working days, depending on the volume of documents and the insurer’s verification process. If the insurer needs clarification, they may reach out for additional documents.

Documents Required for Individual Health Insurance Claims

Submitting complete and accurate documents helps your insurer process your claim faster. Keep the following ready:

Claim form

Hospital bills

Invoice

Discharge summary

Prescriptions

Test reports

Medicine bills

Policy copy or health card

Identity proof

Cancelled cheque or bank account details

Being ready with these documents will help you get the claim amount faster.

Also read: How to Enroll in Individual Health Insurance: Step-by-Step Guide

Common Reasons for Individual Health Insurance Claim Rejection

Even small mistakes can lead to claim rejection. Here are the most common reasons to look out for:

Not disclosing a pre-existing illness at the time of buying the policy

Claiming for treatments that fall under exclusions

Missing, unclear or incomplete documents

Submitting the claim after the allowed timeline

Treatment not matching the medical necessity mentioned in policy conditions

Tips for a Hassle-Free Individual Health Plan Claim Process

A little preparation can make your claim journey smooth and stress-free. Keep these tips in mind.

Inform your insurer or the hospital’s TPA desk as soon as you get admitted

Keep digital and physical copies of all medical records

Read your policy carefully so you know what is included and excluded

Renew your health plan on time to avoid a lapse

Save your insurer’s helpline number for emergencies

Good preparation ensures your insurance support comes through exactly when you need it.

Conclusion

Once you know the process of claiming against your individual health insurance plan, it becomes much simpler. It becomes rather easy, be it cashless or reimbursement, to avoid delays in claim settlement and ensure timely financial support during medical treatment. Keep your policy details handy and ensure all your medical records are kept safe. If you have the right information at hand, then your health insurance claim experience remains hassle-free.

Frequently Asked Questions

Here are common questions on How to File an Individual Health Insurance Claim (Cashless and Reimbursement)

How do I file a cashless health insurance claim?

Visit a network hospital, fill the pre-authorisation form, get approval from the insurer and the hospital will settle the bill directly.

How do reimbursement claims work?

You pay the hospital bill first, collect all documents and submit them to your insurer. The approved amount is later transferred to your bank account.

How long does the claim process take?

Cashless approvals usually take a few hours. Reimbursement claims may take 5 to 15 working days, depending on verification.

What documents are needed for claim approval?

Claim form, hospital bills, discharge summary, prescriptions, diagnostic reports, pharmacy bills, ID proof and bank details.

Recent

Articles

How to File an Individual Health Insurance Claim (Cashless and Reimbursement)

Roocha Kanade Dec 11, 2025

Tax Benefits of Individual Health Insurance Under Section 80D

Roocha Kanade Dec 11, 2025

What Does Individual Health Insurance Cover and Exclude

Roocha Kanade Dec 11, 2025

Eligibility Criteria for Individual Health Insurance in India

Roocha Kanade Dec 11, 2025

Individual Health Insurance Cost: Premium Factors and Ways to Save

Roocha Kanade Dec 11, 2025

All Articles

Want to post any comments?

Discover our diverse range of Health Insurance Plans tailored to meet your specific requirements🏥

✅ 100% Room Rent Covered* ✅ Zero deductions at claims ✅ 7100+ Cashless Hospitals

Check health insurance